Leveraging technology to help agents sell insurance in an efficient and delightful manner

Leveraging technology to help agents sell insurance in an efficient and delightful manner

We often wonder, why, in our fast-paced digital age, do insurance agents still grapple with tons of paperwork and non-real-time processes?

We interviewed over 40 insurance agents to understand the common pain points during a sales journey.

And here is the wishlist from the people we spoke to:

Skip the papers, bring the tablet

Buy insurance without any manual paperwork submissions.

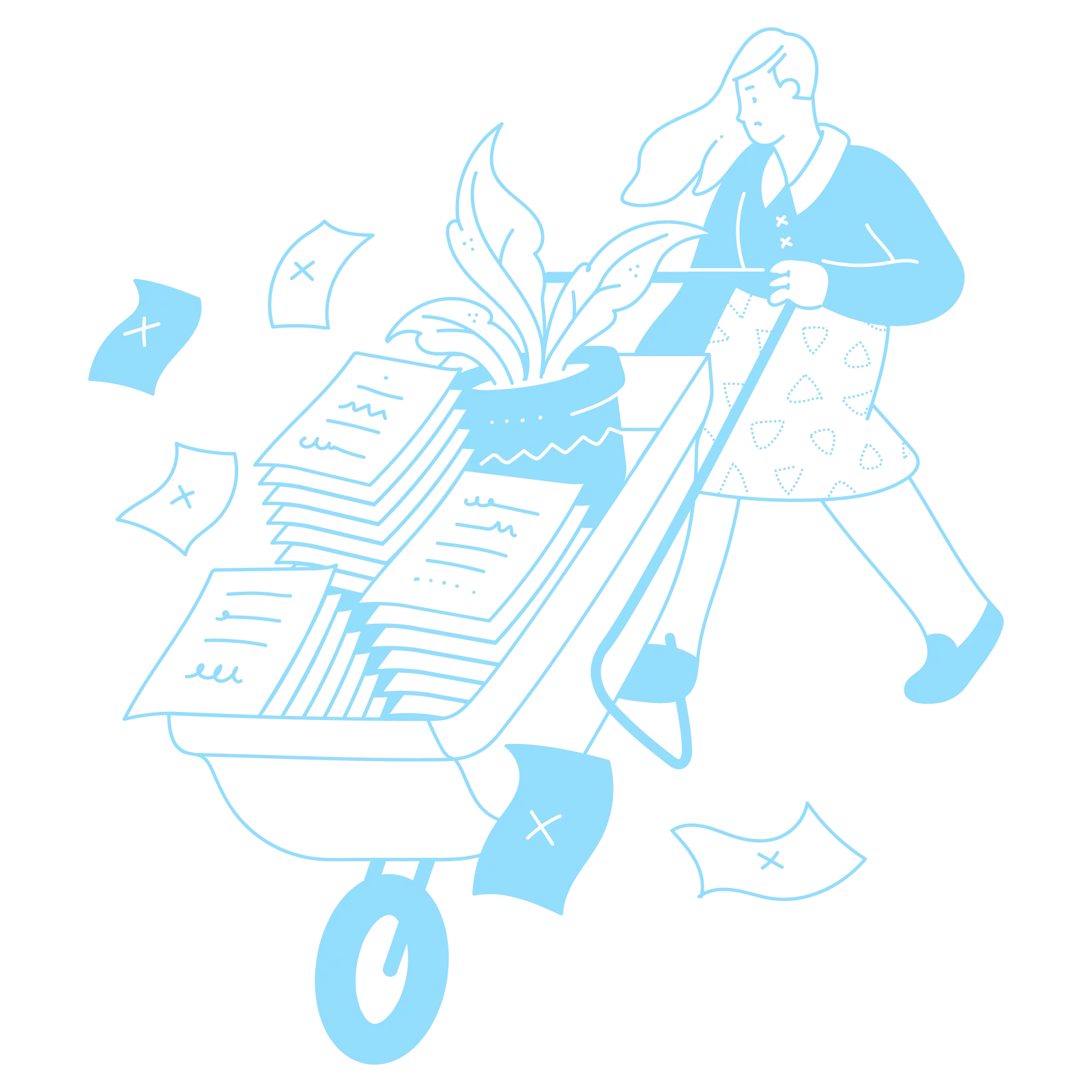

Harness analytics to find the right policy

With cutting-edge analytics at their disposal, agents can now pitch policies that best fit their clients' individual life scenarios.

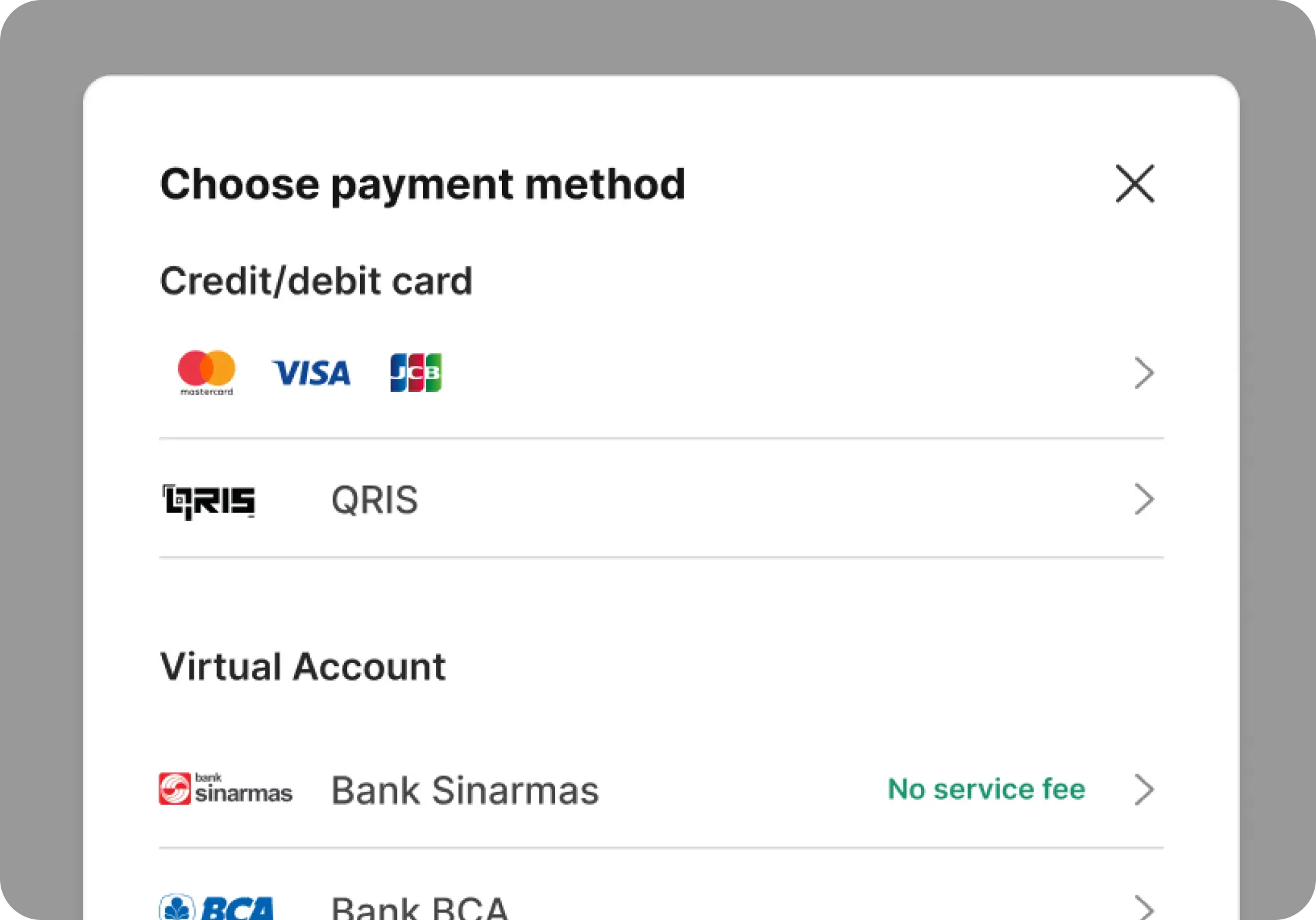

All payment methods accepted

Clients can choose whether to pay upfront or later, cash or cashless or seek assistance from agents to populate client payment details.

Do consultations anytime, anywhere

Text, call, video, or in person? Clients can choose how they want to connect with their agents and can request quotes in advance.

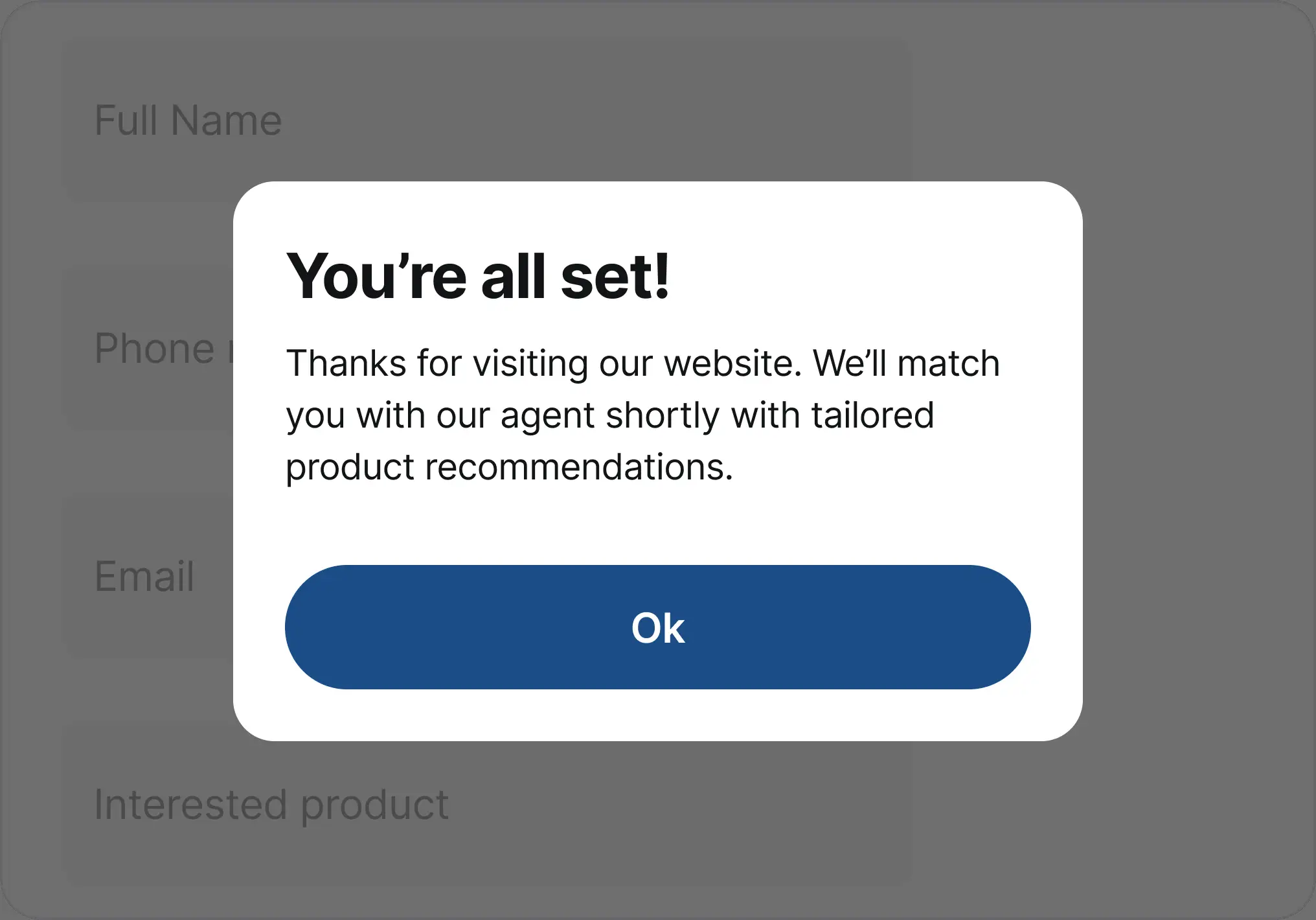

Match clients and agents automatically

Agents can obtain new leads by getting matched with prospects that have indicated their needs on the insurers' websites.

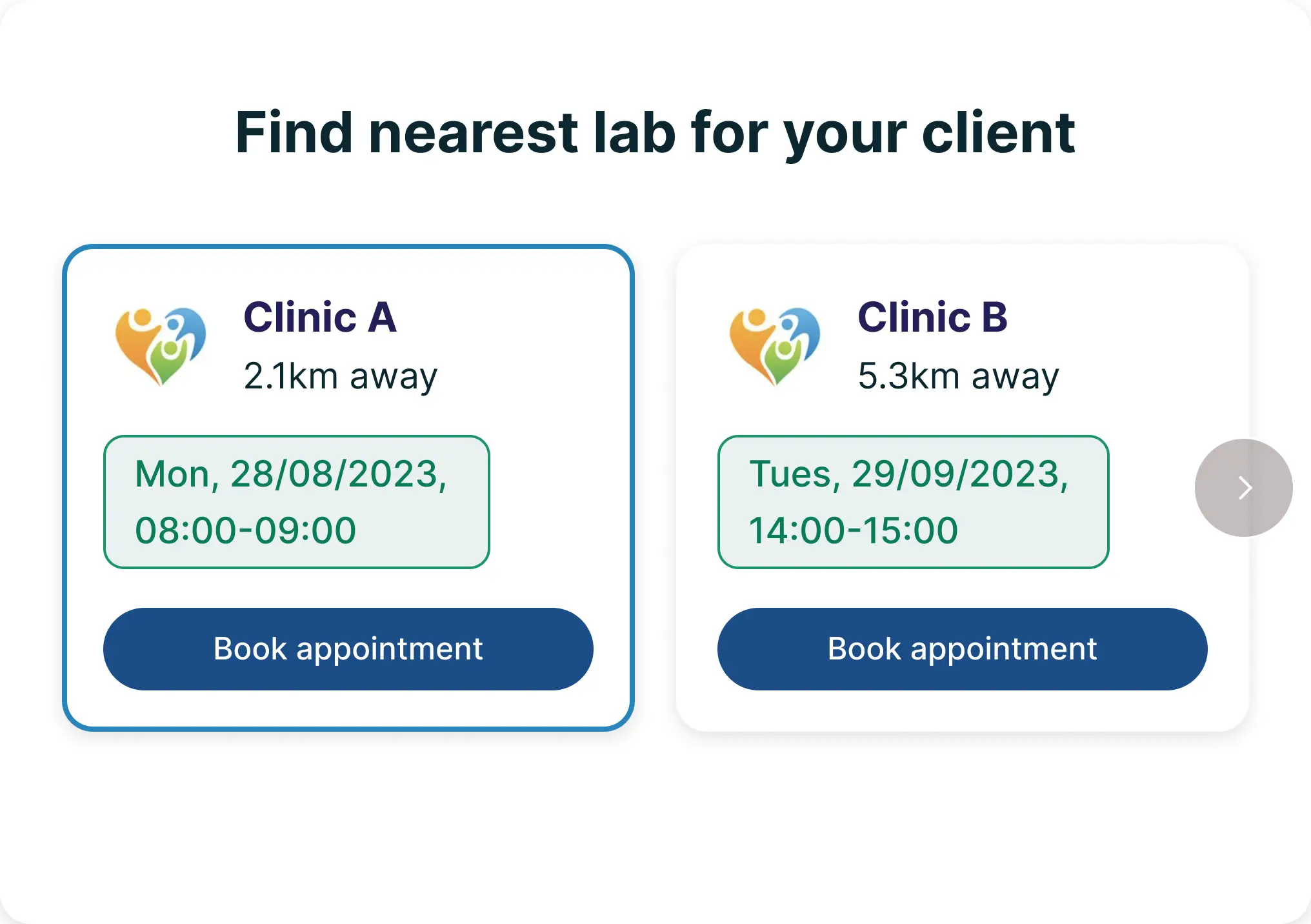

Expedite underwriting with instant health screening

Speed up the underwriting process by instantly booking nearby health screenings for the next available time slot.